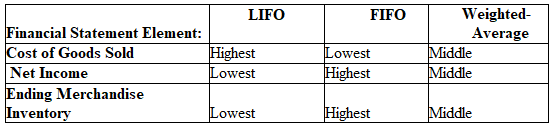

Complete the following table, which compares the effects of LIFO, FIFO, and weighted-average inventory costing methods on the financial statements in periods of rising inventory costs. The answer should be lowest, highest, or middle.

You might also like to view...

Carl, an office supply salesperson, determined during the preapproach process that a prospect could save 25 percent yearly by purchasing a bulk order of 30 units of Carl's general supplies kit. Carl has defined this advantage while developing a(n):

A. customer profile. B. value analysis. C. customized marketing objective. D. customer benefit plan. E. individualized sales call objective.

For _______________ to be successful, individuals from opposing sides need to be genuinely interested in finding a resolution to the problem and willing to listen to each other.

a. Utilitarian conflict b. Functional conflict c. Practical conflict d. Dysfunctional conflict

Gardner Machine Shop estimates manufacturing overhead costs for the coming year at $318,000

The manufacturing overhead costs will be allocated based on direct labor hours. Gardner estimates 5,000 direct labor hours for the coming year. In January, Gardner completed Job A33, which used 70 machine hours and 23 direct labor hours. What was the amount of manufacturing overhead allocated to Job A33? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.) A) $1,463 B) $4,452 C) $5,915 D) $4,543

List the types of agreements that are within the Statute of Frauds and explain the consequences if the parties do not comply with the requirements of the Statute of Frauds.

What will be an ideal response?