The fixed overhead volume variance measures the use of existing facilities and capacity

Indicate whether the statement is true or false

T

You might also like to view...

Gross profit represents the mark-up on ________.

A) sales revenue B) merchandise inventory C) operating expenses D) transportation cost

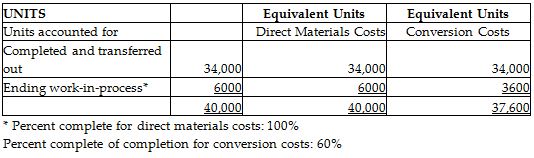

Herbicida Manufacturing produces a chemical herbicide and uses process costing. There are three processing departments—Mixing, Refining, and Packaging. On January 1, the first department—Mixing—had no beginning inventory. During January, 40,000 fl. oz. of chemicals were started in production. Of these, 34,000 fl. oz. were completed, and 6000 fl. oz. remained in process. In the Mixing Department, all direct materials are added at the beginning of the production process, and conversion costs are applied evenly throughout the process. The weighted-average method is used.

At the end of the month, Herbicida calculated equivalent units in the Mixing Department as shown below:

During January, the Mixing Department incurred $49,000 in direct materials costs and $213,000 in conversion costs. How much was the cost per equivalent unit for materials and for conversion costs?

(Use the weighted-average method and round your answer to the nearest cent.)

A) $8.17 per EUP for direct materials and $5.33 per EUP for conversion costs

B) $1.23 per EUP for direct materials and $6.26 per EUP for conversion costs

C) $1.44 per EUP for direct materials and $6.26 per EUP for conversion costs

D) $1.23 per EUP for direct materials and $5.66 per EUP for conversion costs

Amy, a single individual and sole shareholder of Brown Corporation, sold all of the Brown stock for $30,000. Amy's stock basis was $150,000. She had owned the stock for 3 years. Brown Corporation meets the Section 1244 requirements. Amy has

A) a $50,000 ordinary loss and $70,000 LTCL. B) a $50,000 STCL and a $70,000 LTCL. C) a $100,000 ordinary loss and a $20,000 LTCL. D) a $100,000 LTCL and a $20,000 ordinary loss.

WV Construction has two divisions: Remodeling and New Home Construction. Each division has an on-site supervisor who is paid a salary of $106,000 annually and one salaried estimator who is paid $58,000 annually. The corporate office has two office administrative assistants who are paid salaries of $62,000 and $43,000 annually. The president's salary is $171,000. How much of these salaries are common fixed expenses?

A. $171,000 B. $105,000 C. $276,000 D. $368,000