Answer the following statements true (T) or false (F)

1.The Heckscher-Ohlin theory suggests that land-abundant nations will export land-intensive goods while labor-abundant nations will export labor-intensive goods.

2.The Heckscher-Ohlin theory contends that over a period of years, a country that initially is an exporter of a product will become an importer of that product.

3.The Heckscher-Ohlin theory emphasizes the role of consumer demand in the creation of comparative advantage.

4.. The factor-endowment theory asserts that specialization and trade tends to encourage an equalization in the relative resource prices of trading partners.

5.According to the factor-endowment theory, international specialization and trade cause a nation's cheap resource to become cheaper and a nation's expensive resource to become more expensive.

1.True

2.False

3.False

4.True

5.False

You might also like to view...

An employee earns $5,500 per month working for an employer. The FICA tax rate for Social Security is 6.2% of the first $127,200 of earnings each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. The employee has $182 in federal income taxes withheld. The employee has voluntary deductions for health insurance of $150 and contributes $75 to a retirement plan each month. What is the amount the employer should record as payroll taxes expense for the employee for the month of January?

A. $464.75 B. $841.50 C. $420.75 D. $602.75 E. $750.75

A deferred annuity will pay you $500 at the end of each year for 10 years, however the first

payment will not be made until three years from today (payments will be made at the end of years 3 through 12). What amount will you have to deposit today to fund this deferred annuity? Use an 8% discount rate and round your answer to the nearest $100. A) $2,200 B) $3,400 C) $2,400 D) $2,900

A normal probability distribution is a symmetrical distribution whose shape resembles a bell-shaped curve

Indicate whether the statement is true or false

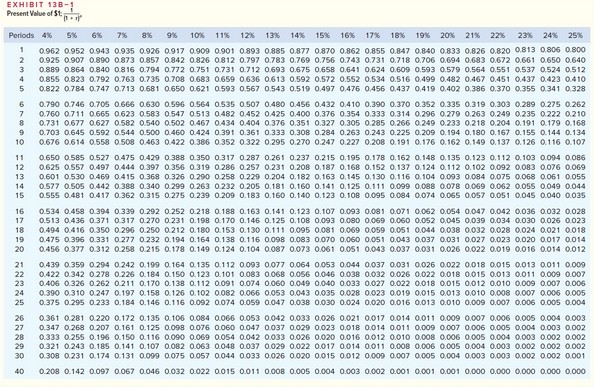

Mester Corporation has provided the following information concerning a capital budgeting project: After-tax discount rate 15?%Tax rate 30?%Expected life of the project 4? Investment required in equipment$100,000? Salvage value of equipment$0? Annual sales$205,000? Annual cash operating expenses$140,000? One-time renovation expense in year 3$25,000? Use Exhibit 13B-1 above to determine the appropriate discount factor(s). The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital

Mester Corporation has provided the following information concerning a capital budgeting project: After-tax discount rate 15?%Tax rate 30?%Expected life of the project 4? Investment required in equipment$100,000? Salvage value of equipment$0? Annual sales$205,000? Annual cash operating expenses$140,000? One-time renovation expense in year 3$25,000? Use Exhibit 13B-1 above to determine the appropriate discount factor(s). The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital

budgeting.The net present value of the project is closest to: (Round intermediate calculations and final answer to the nearest dollar amount.) A. $39,853 B. $139,853 C. $41,956 D. $94,500