Basis

A. will be weak (negative) if local supply today is abundant relative to the supply the market expects at maturation of the futures contract.

B. will be weak if local supply today is tight relative to the supply the market expects at maturation of the futures contract.

C. will be weak (negative) if current supply is tight relative to the supply the market expects at maturation of the futures contract.

D. will be stronger if the local market is further distant from the delivery location stipulated in the futures contract, other things being equal, and if the local market has excess supplies.

Ans: A. will be weak (negative) if local supply today is abundant relative to the supply the market expects at maturation of the futures contract.

You might also like to view...

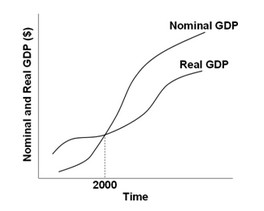

Use the following graph to answer the next question.  The graph suggests that the GDP price index during the period shown was generally ________.

The graph suggests that the GDP price index during the period shown was generally ________.

A. decreasing B. positive C. constant D. increasing

The United States Social Security system

a. pays benefits in direct accordance to what each individual has paid into the system. b. has paid the current generation of recipients less in benefits than it paid in payroll taxes. c. has paid the current generation of recipients more than it paid in payroll taxes. d. paid the earlier generations more and the current generation less than each paid in payroll taxes.

Which of the following would cause a currency to depreciate in a flexible exchange rate market?

a) Rising domestic interest rates. b) Reduced demand for imported goods. c) Increased investment abroad. d) A surge in foreign demand for a country's goods.

If a 1% change in price leads to a 2% change in quantity demanded, then the elasticity of demand is

A. 0.5. B. 1.0. C. 1.5. D. 2.0.