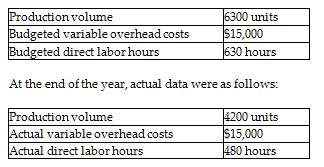

Judd Company uses standard costs for its manufacturing division. Standards specify 0.1 direct labor hours per unit of product. The allocation base for variable overhead costs is direct labor hours. At the beginning of the year, the static budget for variable overhead costs included the following data:

What is the variable overhead cost variance? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

A) $15,000 U

B) $15,000 F

C) $3571 U

D) $4687 F

C) $3571 U

Explanation: Variable overhead cost variance = (Actual cost - Standard cost) × Actual quantity

Standard cost per direct labor hour = Budgeted variable overhead costs / Budgeted direct labor hours = $15,000 / 630 direct labor hours = $23.81 per direct labor hour

Actual cost per direct labor hour = Actual variable overhead costs / Actual direct labor hours = $15,000 / 480 direct labor hours = $31.25 per direct labor hour

Variable overhead cost variance = ($31.25 - $23.81) × 480 units = $3571 Unfavorable

You might also like to view...

What is the current federal minimum wage?

Carla has been directed by her regional marketing manager to cut prices on seasonal items, place an ad in the local paper, and tell distributors to reduce deliveries for the next month. Which step of the strategic marketing planning process is Carla engaged in?

A. identify and evaluate opportunities B. define the business mission C. implement marketing mix and resources D. perform situation analysis E. evaluate performance

TrueBlue wants to gather accurate information about middle managers on dimensions such as leadership ability, ability to delegate, and employee supportiveness. Subordinate evaluations would be good for this purpose.

Answer the following statement true (T) or false (F)

Phones, modems, fax machines, and cable television are all based on analog communications

Indicate whether the statement is true or false