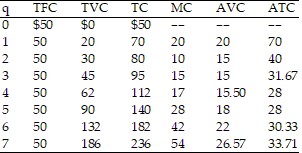

Refer to the data provided in Table 9.1 below to answer the question(s) that follow.

Table 9.1

Refer to Table 9.1. In the long run, if cost conditions do not change, this firm will earn a zero economic profit if price is

A. $10.

B. $15.

C. $20.

D. $28.

Answer: D

You might also like to view...

Which of the following explains why the demand for loanable funds is negatively related to the real interest rate?

A) A lower real interest rate makes more investment projects profitable. B) Consumers are willing to spend less and hence save more at higher real interest rates. C) Interest rate flexibility in financial markets assures an equilibrium in which saving equals investment. D) All of the above are reasons why the demand for loanable funds is negatively related to the real interest rate.

One major characteristic of the price system is that

A) consumers together are the ones who ultimately decide what is produced. B) individual sellers ultimately decide what is produced in the market. C) competition among sellers is reduced. D) all exchanges are regulated by the government.

Suppose the market rate of interest is 5%. The local government imposes a tax of $40 per acre on all land located within city limits. The year after the tax is imposed, Val sells an acre of land on which she had planned to build a house. How much was Val's share of the economic burden of the tax?

a. $0. b. $40. c. $200. d. $800.

Which of the following will be reduced during an expansionary monetary policy?

a. the return to saving b. spending c. borrowing d. money supply