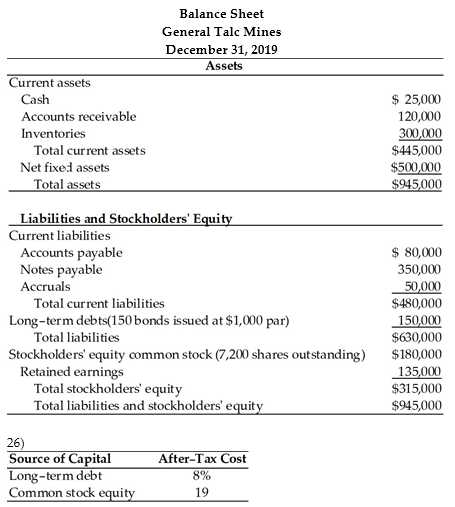

Given this after-tax cost of each source of capital, the weighted average cost of capital using book weights for General Talc Mines is ________.

A) 11.6 percent

B) 15.5 percent

C) 16.6 percent

D) 17.5 percent

B) 15.5 percent

You might also like to view...

Which of the following statements is not true regarding the Sarbanes-Oxley Act (SOX)?

A. The Act is meant to decrease the likelihood of unethical corporate behavior. B. The Act has resulted in increased penalties for financial fraud by top management. C. The Act calls for increased oversight responsibilities for boards of directors. D. The Act calls for decreased independence of outside auditors reviewing corporate financial statements.

Explain what is meant by "the service recovery paradox."

What will be an ideal response?

Which of the following statements is CORRECT?

A. The first, and perhaps the most critical, step in forecasting financial requirements is to forecast future sales. B. Forecasted financial statements, as discussed in the text, are used primarily as a part of the managerial compensation program, where management's historical performance is evaluated. C. The capital intensity ratio gives us an idea of the physical condition of the firm's fixed assets. D. The AFN equation produces more accurate forecasts than the forecasted financial statement method, especially if fixed assets are lumpy, economies of scale exist, or if excess capacity exists. E. Perhaps the most important step when developing forecasted financial statements is to determine the breakdown of common equity between common stock and retained earnings.

What are the four reasons that a company might develop new products and services?

What will be an ideal response?