A tax of 20 percent per unit of imported garlic is an example of a(n)

A) specific tariff.

B) ad valorem tariff.

C) nominal tariff.

D) effective protection tariff.

E) a disadvantageous tariff

B

You might also like to view...

A contract can help a seller to receive better creditors to finance his/her inventory

Indicate whether the statement is true or false

When the U.S. economy is at its full-employment level, the unemployment rate is not equal to zero because:

a. cyclical unemployment is always present in a modern economy. b. of the statistical discrepancy. c. voluntary unemployment is always positive. d. frictional and structural unemployment are always present in a modern economy. e. there are always people who are too lazy to work.

"Only individual members of society earn income, not society itself." This statement is most closely associated with the political philosophy of a

a. utilitarian. b. liberal. c. libertarian. d. None of the above is correct.

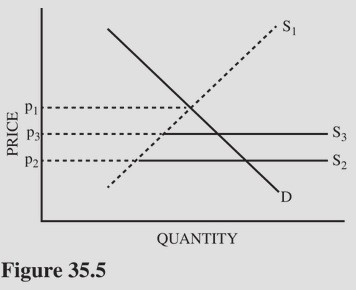

Refer to Figure 35.5. S1 represents the U.S. domestic supply of a good and S2 represents supply in the United States under conditions of free trade. If the United States imposes a tariff on this good, what will happen to the quantity imported?

Refer to Figure 35.5. S1 represents the U.S. domestic supply of a good and S2 represents supply in the United States under conditions of free trade. If the United States imposes a tariff on this good, what will happen to the quantity imported?

A. Imports will increase as price increases and domestic production increases. B. Imports will decline as price increases and domestic production decreases. C. Imports will decline as price increases and domestic production increases. D. Imports will increase because producers will pass the cost of the tariff on to consumers.