Collateral is

A) the interest rate that banks charge high-quality borrowers.

B) assets pledged to the bank in the event the borrower defaults.

C) the difference between the value of a bank's assets and the value of a bank's liabilities.

D) required reserves minus excess reserves.

B

You might also like to view...

At the conclusion of its meeting on January 27, 2016, the Federal Open Market Committee released a statement that included the following sentence: "Given the economic outlook, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent. The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and return to 2 percent inflation ." What is the significance of this statement?

What will be an ideal response?

Sketch graph a standard short-run production functions, and identify on it the points where the average product peaks, the marginal product peaks, the marginal product reaches zero, and the average and marginal product intersect.

What will be an ideal response?

The passage of new legislation that imposes much less government regulation of business will most likely:

a. Increase aggregate demand b. Decrease aggregate supply c. Decrease aggregate demand d. Increase aggregate supply

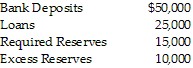

Given the following information about AAA bank: What is the reserve ratio?

What is the reserve ratio?

A. 50 percent B. 30 percent C. 20 percent D. 15 percent