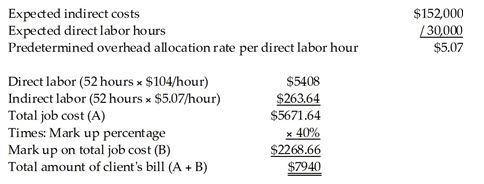

Baptiste Accounting Services expects its accountants to work a total of 30,000 direct labor hours per year. The company's estimated total indirect costs are $152,000. The direct labor rate is $104 per hour. The company uses direct labor hours as the allocation base for indirect costs. If Baptiste performs a job requiring 52 hours of direct labor and bills the client using a standard markup of 40% of costs, calculate the amount of the client's bill. (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

A) $5408

B) $216,320

C) $2269

D) $7940

D) $7940

Explanation:

You might also like to view...

The difference between the principal amount of a note and its maturity value is called ____________________

Fill in the blank(s) with correct word

Very small, well-defined groups of customers are often referred to as individuals.

Answer the following statement true (T) or false (F)

“What are the skills of each member?” is a key question to ask when determining the ______ of your TRIM framework.

a. Team b. Resources c. Idea d. Market

A change is initiated in the psychological contract between an employee and an organization if the

A. employee is satisfied with his performance. B. organization achieves a perfect person-job fit. C. organization sees an imbalance. D. employee perceives it to be fair. E. organization perceive it to be equitable.