Smartmoney, Inc. was formed by three wealthy dentists to pool their investment funds. They each invested $200,000 in the corporation, which was immediately used to purchase stocks to be held as investments. The first year, the corporation received dividends of $70,000 and filed a tax return paying a corporation tax in the amount of $7,350 [($70,000 dividends - $35,000 DRD) × .21 = $7,350]. The

IRS audits this corporation and sends a tax bill in the amount of $12,530 ($62,650 UPHCI × 0.20 = $12,530) plus underpayment penalty and interest. What is this additional tax and what should the dentists do about it? What action(s) do you recommend the corporation take for the tax year in question and subsequent tax years?

What will be an ideal response?

This additional tax that was imposed is the personal holding company tax. The dentists should arrange to have the corporation pay deficiency dividends so as to avoid the penalty tax. The interest and penalties that have been imposed cannot be avoided by the payment of the deficiency dividend. The dentists should consider liquidating the corporation and have the assets held individually by the shareholders. The liquidating distributions are eligible for the dividends-paid deduction and can reduce the UPHCI amount. An S election might be considered. It could alleviate the personal holding company problem for future tax years, but not for prior tax years.

You might also like to view...

When determining the sample size, the standard deviation may not be known. Which of the following was not mentioned in your text as a way to estimate the standard deviation?

A) consult secondary sources B) estimate based on researcher judgment C) estimate from the mean D) conduct a pilot study

Tactics designed to create power equalization are often employed as a way to

A. diminish the expert power of the other party. B. block the other's power moves. C. level the playing field. D. gain advantage in a distributive bargaining situation.

According to the persuasion matrix, which of the following is an independent variable in the consumer's response process?

A. attention B. yielding C. comprehension D. retention E. destination

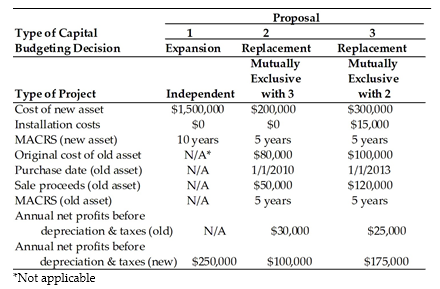

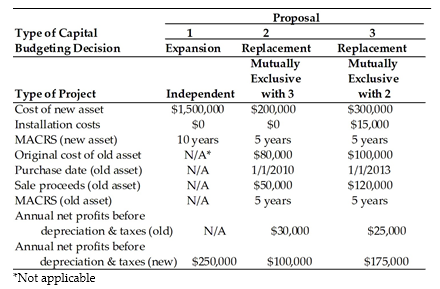

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2019. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. New assets will be depreciated under the MACRS system rather than being fully expensed right away. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2019. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. New assets will be depreciated under the MACRS system rather than being fully expensed right away. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

A) $1,380,000

B) $1,440,000

C) $1,500,000

D) $1,620,000