A situation in which managers pursue goals and objectives that are in the best interests of a particular segment rather than in the best interests of the organization as a whole is referred to as ____________________

Fill in the blank(s) with correct word

suboptimization

You might also like to view...

Given the multiple regression equation, ? = a+b1X1+b2X2, and the bivariate equation ? = a+bX1, why is the partial regression coefficient, b1,different from the regression coefficient, b, obtained by regressing Y on only X1?

What will be an ideal response?

The Governmental Accounting Standards Board is a branch of the Financial Accounting Foundation

Indicate whether the statement is true or false

Metallic Engineering, Inc., a manufacturer of fabricated aluminum products for aerospace, engineering, automotive, and custom industrial applications, is calculating its WACC. The firm’s common stock just paid a dividend of $1.5 per share and now is selling for $30. The firm’s financial staff estimates the company’s new product will generate an unusual high dividend growth rate of 17% for four years. After this period of time, the dividend growth rate will decline to 3% during a transition period of 3 years, rather than instantaneously. The firm’s debt-to-equity ratio is 3/4 and the flotation costs for new equity will be 7%. Also, the firm has a payout ratio of 60% and 20M of common shares of stock outstanding.

a) Based on the information above, determine the firm’s estimated retained earnings and the associated break-point.

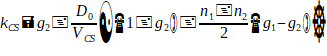

b) Calculate the firm’s cost of retained earnings and the cost of new common equity. Hint: use the required rate of return kCS derived from the H-Model formula in Chapter 9 as follows:

c) If Metallic Engineering’s after-tax cost of debt is 5%, determine the WACC with retained earnings and new common equity.

What is the "representation gap"? What evidence, if any, exists to suggest that there may be a representation gap in the United States?

What will be an ideal response?