If the face value of a bond is $10,000,000, the coupon rate is 7%, and the inflation rate is 4%, then the annual coupon payment made to the holder of the bond is

A. $400,000.

B. $700,000.

C. $70,000.

D. $300,000.

Answer: B

You might also like to view...

Of the following, the best example of private information is when

A) Michael knows the price of a gallon of milk at the minimart but Michelle doesn't know. B) you know some of your used car's defects but a potential buyer cannot find out about them until after buying. C) you don't know the quality of a used car and must hire a trained mechanic who tells you all its defects. D) you pay the owner of a used car a little extra and she lets you know all of the car's defects.

Maggie is trying to convince her friend Hannah to spend the morning at the beach instead of studying economics. Maggie’s argument is that the beach is free so will not cost Hannah anything to go. Maggie even volunteers to drive. Maggie’s argument

a. is correct; it is free to go to the beach. b. is forgetting Hannah’s opportunity cost of not being able to study. c. assumes Hannah has to eat at home or the beach so it will not cost Hannah additional money. d. is forgetting sunk costs.

When a firm wants to borrow directly from the public to finance the purchase of new equipment, it does so by selling bonds

a. True b. False Indicate whether the statement is true or false

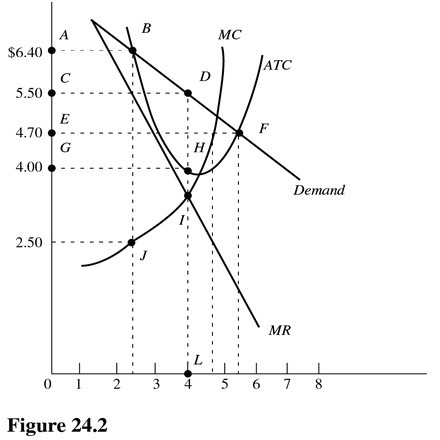

In Figure 24.2, the profit-maximizing level of output is

In Figure 24.2, the profit-maximizing level of output is

A. Between 4 and 5 units. B. 4 units. C. Between 2 and 3 units. D. Between 5 and 6 units.