The government's ability to coerce can enhance economic efficiency by:

A) restraining self-interest.

B) preventing resources from going to their most valued uses.

C) eliminating income inequality.

D) correcting market failures.

D) correcting market failures.

You might also like to view...

Everything else being equal, a higher interest rate

a. increases consumption spending as people face increasing debt b. reduces consumption spending as people have a greater incentive to save c. does not change consumption spending because consumption is only affected by income d. does not change total consumption spending, but does change who does the spending e. reduces both consumption spending and saving as people face increased debt

The Bush tax cuts

a. reduced tax rates for the upper brackets and increased tax rates for lower income taxpayers. b. reduced tax rates for the upper brackets and held constant tax rates for lower income taxpayers. c. reduced tax rates for the upper brackets and decreased tax rates for lower income taxpayers. d. held constant tax rates for the upper brackets and decreased tax rates for lower income taxpayers. e. Increased tax rates for the upper brackets and decreased tax rates for lower income taxpayers.

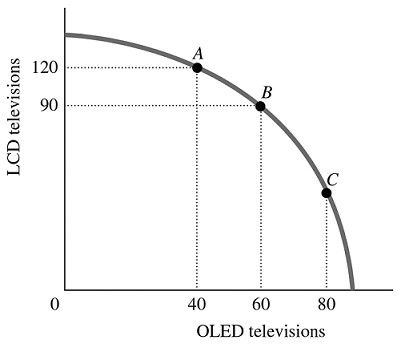

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point B to Point A is

Figure 2.5Refer to Figure 2.5. The marginal rate of transformation in moving from Point B to Point A is

A. -2/3. B. -3/4. C. -1.5. D. -20.

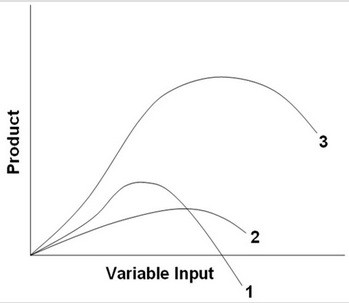

In the above diagram curves 1, 2, and 3 represent the:

In the above diagram curves 1, 2, and 3 represent the:

A. total, average, and marginal product curves respectively. B. total, marginal, and average product curves respectively. C. marginal, average, and total product curves respectively. D. average, marginal, and total product curves respectively.