How do supply-side economists see reducing taxes as a way to improve productivity?

What will be an ideal response?

First, lower taxes raise the after-tax return for work, making work more attractive and leisure more expensive. This encourages people to work longer hours, enter the workforce, delay retirement and avoid long periods of unemployment. Reducing taxes also increases the incentives to save and invest. Lower taxes raise the after-tax rate of return on savings, making savings more attractive. Lower taxes on capital income increase after-tax rates of return on investment spending, encouraging investment. Supply-side economists argue that all of these effects combine to raise the productivity level of the economy.

You might also like to view...

What will be an ideal response?

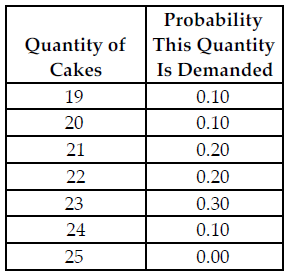

Refer to the table below. Busy Betty sells her cakes for $20 each and her constant marginal cost to produce each cake is $12, which is equal to her (constant) average total cost. If she does not sell a cake the day she makes it, she sells it as day-old cake for $10. What is her expected marginal cost of holding the 20th cake in inventory?

The above table shows the probability distribution of cake sales at Busy Betty's Bakery.

A) $0.40

B) $10.00

C) $0.20

D) $2.00

If at some interest rate desired investment is $400 billion, desired private saving is $600 billion, and the budget deficit is $300 billion, is there a surplus or a shortage in the market for loanable funds? What does this imply would happen to interest rates?

Which of the following would expand aggregate demand according to Keynesians, while stimulating aggregate supply according to modern supply-siders?

A. Increasing transfer payments B. Open-market purchases of Treasury bonds by the Fed C. Cutting the discount rate and reserve requirements on demand deposits D. Cutting personal and corporate marginal tax rates