Individuals and corporations can buy or sell forward currencies to hedge their exchange rate exposure. Essentially, the process involves simultaneously selling the currency expected to appreciate in value and buying the currency expected to depreciate.

Answer the following statement true (T) or false (F)

False

You might also like to view...

If receipts from cash sales of $7,500 were recorded incorrectly as $5,700 in the company's books, then this item would be included on the bank reconciliation as a(n)

a. deduction from the balance per company's records b. addition to the balance per bank statement c. deduction from the balance per bank statement d. addition to the balance per company's records

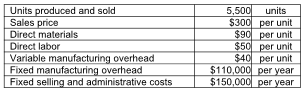

There are no beginning inventories. Prepare an income statement using the contribution margin format.

The following data has been provided by Jestina, Inc. for the year.

A company is considering a project with annual after-tax cash flows of $5,600.00 per year for six years. The company's cost of capital is 14 percent. Present and future value factors for a 14 percent interest rate for six years are as follows: Future value of $1 2.195 Present value of $1 0.456 Future value of a series of equal payments 8.536 Present value of a series of equal payments 3.889 Using

the net present value method, what is the maximum amount that the company should invest? a. $21,778.40 b. $47,801.60 c. $12,292.00 d. $2,553.60

The mission statement of the Financial Accounting Standards Board includes a goal of promoting international comparability of accounting standards. Furthermore, the International Accounting Standards Board has begun over the last 20 years to issue

international accounting standards designed to create a common set of international accounting and reporting standards. Identify reasons why such a set of international accounting standards would be desirable.