A tariff is a

a. tax on exports.

b. penalty imposed on exporters who export a greater quantity than the quota allows.

c. penalty imposed on importers who import a greater quantity than the quota allows.

d. tax on imports.

d. tax on imports.

You might also like to view...

At an interest rate of 4 percent, what would be the present value of receiving $4,000 four years from now?

A) $3,420 B) $3,637 C) $3,704 D) $3,847

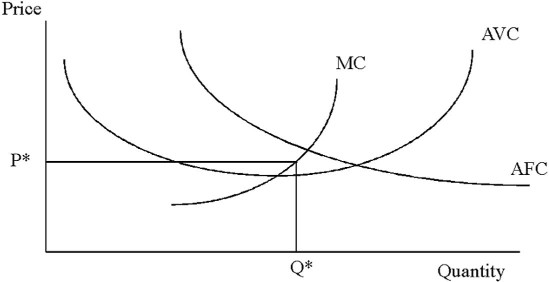

In the graph below at a price of P*, the profit maximizing level of output is

A. Q*. B. zero. C. below Q* but above zero. D. above Q*.

Tax Incidence

What will be an ideal response?

To derive the market demand curve for a private good, one sums the ________. For a public good, one sums the ________.

A. individual prices at various quantities; individual quantities at various prices B. individual quantities at various prices; individual quantities at various prices C. individual prices at various quantities; individual prices at various quantities D. individual quantities at various prices; individual prices at various quantities