Full-cost transfer-pricing frequently:

A. understates the opportunity costs of external transfers.

B. understates the opportunity costs of internal transfers.

C. overstates the opportunity costs of internal transfers.

D. overstates the opportunity costs of external transfers.

Answer: C

You might also like to view...

Suppose you have two investments to choose from:

1, A one-year $20,000 zero coupon bond 2, A two-year $20,000 zero coupon bond What is the difference between the prices of these bonds if the interest rate rises from 4% to 5%? A) You would lose $167.39 more on the two year bond. B) You would lose $167.39 more on the one year bond. C) You would gain $350.54 more on the two year bond. D) You would lose $183.15 more on the one year bond.

Bounded rationality suggests that

A) individuals might make "incorrect" decisions because they are unable to consider all possible options. B) individuals would rather have less choice to more choice. C) rational decisions can only be made when choices are restricted. D) individuals are happier when their choices are restricted or "bounded."

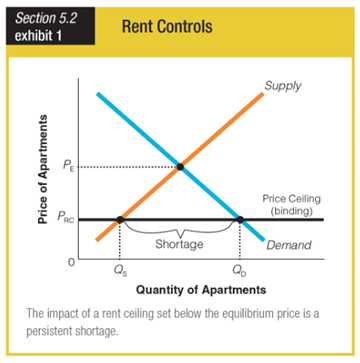

If many landlords convinced many tenants to leave their rent-control apartments, how would the graph most likely change?

a. PRC would increase.

b. PRC would decrease.

c. PE would decrease.

d. PE would increase.

At its regular meetings, the FOMC decides to sell or buy government bonds, an action referred to as ______.

a. reserve requirement alterations b. open market operations c. discount rate management d. interest rate changes