Excise taxes

A. are aimed at a specific good or service.

B. are aimed at a wide range of products.

C. are direct taxes.

D. are generally progressive in nature.

A. are aimed at a specific good or service.

You might also like to view...

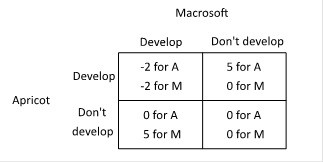

Suppose two companies, Macrosoft and Apricot, and considering whether to develop a new product, a touch-screen t-shirt. The payoffs to each of developing a touch-screen t-shirt depend upon the actions of the other, as shown in the payoff matrix below (the payoffs are given in millions of dollars).  Suppose Apricot makes its decision first, and then Macrosoft makes its decision after seeing Apricot's choice. What will be the equilibrium outcome of this game?

Suppose Apricot makes its decision first, and then Macrosoft makes its decision after seeing Apricot's choice. What will be the equilibrium outcome of this game?

A. Apricot will develop a touch-screen t-shirt, and Macrosoft will not. B. Macrosoft will develop a touch-screen t-shirt, and Apricot will not. C. Neither Apricot nor Macrosoft will develop a touch-screen t-shirt. D. Both Apricot and Macrosoft will develop a touch-screen t-shirt.

Using the table provided above, what can be concluded about the Gini ratio and what does this mean for income equality?

A) The Gini ratio is increasing which means there is greater income inequality. B) The Gini ratio is increasing which means there is greater income equality. C) The Gini ratio is decreasing which means there is greater income equality. D) The Gini ratio is decreasing which means there is greater income inequality.

Suppose a loaf of bread sold for $3.00 in 2008 . The price of bread then increases to $3.60 in 2009 . The price index for bread considering 2008 as the base year is _____

a. 1.20 b. 83.33 c. 120 d. 100 e. 20

Increases in the supply of scientists and engineers can increase the level of

a. investment. b. consumption. c. government spending. d. technology.