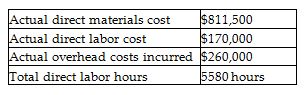

Doric Agricultural Corporation uses a predetermined overhead allocation rate based on the direct labor cost. The manufacturing overhead cost allocated during the year is $270,000. The details of production and costs incurred during the year are as follows:

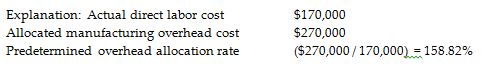

What is the predetermined overhead allocation rate applied by the corporation? (Round your answer to two decimal places.)

A) 96.30%

B) 65.38%

C) 158.82%

D) 33.27%

C) 158.82%

You might also like to view...

When a periodic inventory system is used, ________.

A) an adjusting entry is needed to record the ending Merchandise Inventory account balance B) the process for closing the Income Summary and Dividends accounts differs from the process used in the perpetual inventory system C) beginning Merchandise Inventory, Purchases, and Freight In accounts are closed via the Income Summary Account D) there is no need to take a physical count of inventory

The materiality concept states that a company must ________.

A) report only such information that enhances the financial position of the company B) perform strictly proper accounting only for significant items C) report enough information for outsiders to make knowledgeable decisions about the company D) use the same accounting methods and procedures from period to period

Dealer brands are brands created by producers.

Answer the following statement true (T) or false (F)

Incentive programs for sales staff would be considered a state of nature for a business firm

Indicate whether the statement is true or false