The Gerald Company budgeted overhead at $480,00 . for the period for Department A based on a budgeted volume of 60,00 . direct labor hours. At the end of the period, the factory overhead control account for Department A had a debit balance of $475,000 . actual direct labor hours were 58,000 . What was the under- or over applied factory overhead for the period?

a. $8,00 . overapplied

b. $11,00 . overapplied

c. $11,00 . underapplied

d. $8,00 . underapplied

c

You might also like to view...

______ is built through risk and confirmation and broken through risk and disconfirmation.

Fill in the blank(s) with the appropriate word(s).

Which of the following is true of adopting the Restatement (Third) of Torts: Product Liability?

A) The seller's liability differed depending on whether the defect was a manufacturing defect, a design defect, or a defective warning. B) The seller's liability differed depending on whether the plaintiff was a merchant, a consumer, or a minor. C) The privity limitation was reinstated as a defense to product liability lawsuits. D) The state-of-the-art defense is permitted by courts in most strict liability cases.

In recent years, ________ risk analysis has become of increasing concern to multinational companies because of the growing number of countries that are finding their economies in trouble as in Southeast Asia or, even worse, unable to make the transition to a market-driven economy.

A. complex B. basic C. macro D. micro

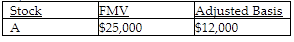

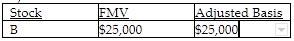

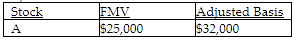

Rita, who has a marginal tax rate of 37%, is planning to make a gift to her grandson who is in the lowest tax bracket. Which of the following holdings of stock would be the most tax advantageous gift from Rita's perspective?

A)

B)

C)

D) For income tax purposes, Rita will be indifferent as to choice of stock to gift.