Which of the following statements about absorption costing and variable costing is true?

a. Sales minus variable cost of goods sold equals contribution margin.

b. Absorption costing treats fixed overhead as a period cost.

c. GAAP requires that variable costs be used for external reporting.

d. Variable costing treats fixed overhead as a product cost.

a

You might also like to view...

Although opportunity costs are not recorded in the financial records, they nevertheless are useful for decision making.

Answer the following statement true (T) or false (F)

Total payroll for a given week is $12,000 . If 70 percent of the company's employees typically qualify to receive two weeks' paid vacation per year, assuming 50 working weeks, the entry to record the estimated liability for vacation pay for the week is:

a. Estimated Liability for Vacation Pay 840 Cash 840 b. Vacation Pay Expense 480 Cash 480 c. Vacation Pay Expense 336 Estimated Liability for Vacation Pay 336 d. Cash 168 Estimated Liability for Vacation Pay 168

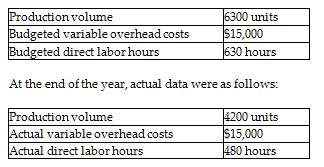

Judd Company uses standard costs for its manufacturing division. Standards specify 0.1 direct labor hours per unit of product. The allocation base for variable overhead costs is direct labor hours. At the beginning of the year, the static budget for variable overhead costs included the following data:

What is the variable overhead cost variance? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

A) $15,000 U

B) $15,000 F

C) $3571 U

D) $4687 F

"The season for cherry blossoms is here with us and everybody is beginning to feel refreshed" is an appropriate beginning for a letter written by persons from which of the following countries?

a. France b. Germany c. Japan d. Latin America