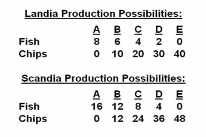

Refer to the given data. Which of the following would be feasible terms of trade between Landia and Scandia?

Answer the question on the basis of the following production possibilities data for Landia and Scandia:

A. 1 fish for 4 chips.

B. 1 fish for 6 chips.

C. 1 fish for 7 chips.

D. 2 fish for 4 chips.

A. 1 fish for 4 chips.

You might also like to view...

To make child daycare more affordable, government advisors are debating two possible options. Plan A is to give daycare centers a $100 subsidy per month per child. Plan B is to give the parents $100 reduction in taxes per month per child in daycare. Which plan benefits parents more?

a. Plan A because it will increase the supply of childcare and decrease the price. b. Plan B because the $100 goes directly to the parents. c. The plans are equivalent in terms of their impact on the price minus subsidy paid by parents. d. Plan A because the price will fall, while under Plan B the price will rise.

What is the interest rate that should be used to ensure a total balance of $3,000 two years from now if you have a starting balance of $2,000?

What will be an ideal response?

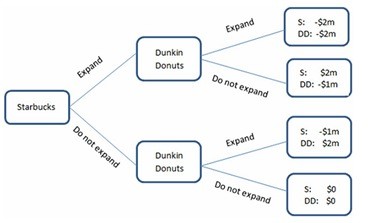

This figure displays the choices being made by two coffee shops: Starbucks and Dunkin Donuts. Both companies are trying to decide whether or not to expand in an area. The area can handle only one of them expanding, and whoever expands will cause the other to lose some business. If they both expand, the market will be saturated, and neither company will do well. The payoffs are the additional profits (or losses) they will earn.The game in the figure is shown using a:

This figure displays the choices being made by two coffee shops: Starbucks and Dunkin Donuts. Both companies are trying to decide whether or not to expand in an area. The area can handle only one of them expanding, and whoever expands will cause the other to lose some business. If they both expand, the market will be saturated, and neither company will do well. The payoffs are the additional profits (or losses) they will earn.The game in the figure is shown using a:

A. decision matrix. B. flowchart. C. graph. D. decision tree.

Winnebago Industries Inc. reports the following selected information for its fiscal year ended August 25, 2018

Winnebago Industries Inc. reports the following selected information for its fiscal year ended August 25, 2018 ($ thousands).

| Contributed capital, August 26, 2017 | $106,289 |

| Treasury stock, August 26, 2017 | (342,730) |

| Retained earnings, August 26, 2017 | 679,138 |

| Accumulated other comprehensive (loss) income, August 26, 2017 | (1,023) |

During fiscal year 2018, Winnebago reported the following:

| 1. Issuance of stock | $ 5,822 |

| 2. Repurchase of stock | 4,644 |

| 3. Net income | 102,416 |

| 4. Cash dividends | $12,738 |

| 5. Other comprehensive income/ (loss) | 1,915 |

Use this information to prepare the statement of stockholders' equity for Winnebargo's for fiscal year August 25, 2018.