A 10 percent tax is going to be applied to a $100,000 tax base. What can be said about the revenue collected assuming static tax analysis?

A. The total revenue will be zero.

B. The total revenue will be between $0 and $10,000.

C. The total revenue will be $10,000.

D. There is not enough information to determine what revenues will equal.

Answer: C

You might also like to view...

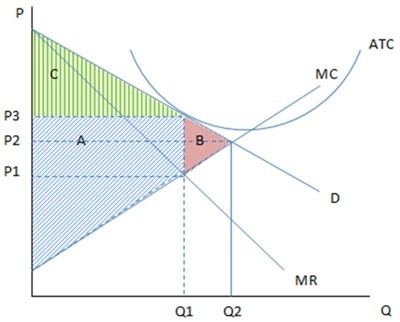

These are the cost and revenue curves associated with a firm. Assuming the firm in the graph is producing Q1 and charging P3, it is likely showing the cost and revenue curves of a firm in:

Assuming the firm in the graph is producing Q1 and charging P3, it is likely showing the cost and revenue curves of a firm in:

A. the long run, and no firms will enter or exit. B. the short run, and firms will leave this market. C. the long run, and firms will enter this market. D. the short run, and firms will enter this market.

When the marginal propensity to consume foreign imports (MPCF) rises, ceteris paribus, what happens to the trade balance?

a. It increases. b. It decreases. c. It depends on what happens to the MPC of domestic goods. d. It will not change.

The rate of growth of output per capita for the United States and France between 1985 and 2014 has been caused by

A) the rate of technological progress. B) the saving rate. C) the accumulation of capital. D) the rate of growth of N.

The credit risk a bank faces is the risk resulting specifically from:

A. the economy entering a recession. B. some of the bank's loans not being repaid. C. the bank experiencing a decrease in deposits. D. interest rates falling.