Production costs per case total $19, which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced). Eight percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Anchovy, Inc., a producer of frozen pizzas, began operations this year. During this year, the

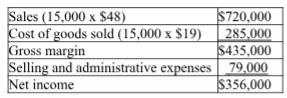

company produced 16,000 cases of pizza and sold 15,000. At year-end, the company reported the following income statement using absorption costing:

Income under absorption costing = Income under variable costing + FOH in Ending

inventory — FOH in Beginning inventory

$356,000 = Income under variable costing ($3.50 x 0 units) + ($3.50 × 1,000 units) $352,500 = Income under variable costing

You might also like to view...

A service organization's capacity to satisfy demand is constrained by all of the following EXCEPT ____________

a. physical facilities b. equipment c. personnel d. sequence of services provided e. number of competitors

The cornerstone attitude of an outstanding team player is to

A) make sure he or she gets individual recognition. B) have competitive attitudes toward other team members. C) aspire to be the team leader. D) trust team members.

Substantial compliance with Article 9's financing statement requirements is sufficient for a valid perfection, despite minor errors in the statement that are not seriously misleading

Indicate whether the statement is true or false

President Franklin D. Roosevelt declared that consumers are entitled to safety, to be informed, to choose, and to be heard.

Answer the following statement true (T) or false (F)