Demi loves playing online games. She surfs through many websites to find new, interesting games. One day she finds that her mailbox is filled with emails suggesting websites for online games and ads promoting a few online offers. In this scenario, a(n) _____ tracks Demi's computer behavior to send her targeted mails and ads.

A. firewall

B. spyware

C. bastion host

D. attack tree

Answer: B

You might also like to view...

When parties have a dispute over how to interpret a union contract and that dispute cannot be resolved internally, they may engage in _______________________________ which involves a hearing before a third-party neutral, who issues a decision that is binding on the parties.

Fill in the blank(s) with the appropriate word(s).

Which organizational structure violates the unity of command principle?

a. functional b. matrix c. territorial d. multiple e. product

During the current year, Margie earned wage income of $300,000. If Margie is single, which of the following statements regarding her Medicare tax liability is true?

A. Margie will owe the regular 1.45 percent Medicare tax on her entire wage income and the additional .9 percent Medicare tax only on her wage income in excess of $200,000. B. Margie will owe the regular 1.45 percent Medicare tax on her entire wage income and the additional .9 percent Medicare tax only on her wage income in excess of $250,000. C. Margie's employer is required to withhold both the regular Medicare tax but does not withhold the additional .9 percent Medicare tax. D. Margie will owe both the regular 1.45 percent Medicare tax and the additional .9 percent Medicare tax on her entire wage income.

Ezinne transfers land with an adjusted basis of $50,000 and a FMV of $95,000 to a new business in exchange for a 50% ownership interest. The land is subject to a $60,000 mortgage which the business will assume. The business has no other liabilities outstanding. Indicate the amount of gain recognized by Ezinne due to this exchange if the building is transferred to (1) a corporation and (2) a

partnership. Assume Sec. 351 is satisfied in the case of the corporation and Sec. 721 is satisfied in the case of the partnership.

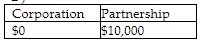

A)

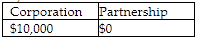

B)

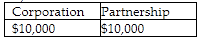

C)

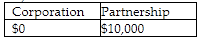

D)