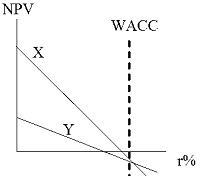

The IRR of normal Project X is greater than the IRR of normal Project Y, and both IRRs are greater than zero. Also, the NPV of X is greater than the NPV of Y at the cost of capital. If the two projects are mutually exclusive, Project X should definitely be selected, and the investment made, provided we have confidence in the data. Put another way, it is impossible to draw NPV profiles that would suggest not accepting Project X.

Answer the following statement true (T) or false (F)

False

Rationale:

You might also like to view...

What is the theory stating that context influences expectations for how interactions will occur?

A. social comparison theory B. expectancy violations theory C. accommodation theory D. social exchange theory

Which of the following demonstrates effective business writing?

A) An Asian CEO was the keynote speaker. B) An African-American man was the next customer. C) A record number of Japanese investors are purchasing real estate in the United States. D) Mr. Hernandez, a Mexican, is my boss.

The value of a project depends on the cost of the project

Indicate whether the statement is true or false

Marketing managers should plan time for strategy changes and not put undue pressure on the people in their organization to perform heroic efforts.

Answer the following statement true (T) or false (F)