In England the Thatcher government substituted a "poll tax" for the local property tax. People took strong exception to the tax, which is basically a head or "lump sum" tax. The principle of taxation such a tax violates is called

a. the benefits principle.

b. the excess burden principle.

c. the ability-to-pay principle.

d. the constitutional principle.

c

You might also like to view...

According to the monetarists, the primary cause of changes in real output and the price level is changes in ____________.

Fill in the blank(s) with the appropriate word(s).

Why does a tax change affect aggregate demand?

A. A tax change alters saving by an equal amount. B. A tax change alters imports and net exports. C. A tax change alters government spending by an equal amount. D. A tax change alters disposable income and consumption spending.

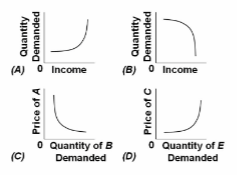

Refer to the diagrams. The case of an inferior good is represented by figure:

A. A.

B. B.

C. C.

D. D.

A monopolistically competitive industry is characterized by ________ concentration ratios and ________ entry barriers.

A. high; low B. low; low C. low; high D. high; high