X owns an easement in Y's property that permits X to operate his factory so that polluted air can travel over Y's property. X's easement is an example of:

A) A negative easement

B) An affirmative easement.

C) A profit.

B

You might also like to view...

A company selling diapers knows the market is for people with infants and toddlers. However, within that segment, it can further divide the market by a demographic factor like:

A. culture. B. lifestyle. C. consumption pattern. D. income.

In a regression problem the following pairs of (x, y) are given: (-2, 4 ), (-1, 1 ), (0, 0 ), (1, 1 ) and (2, 4 ). What is the value of the coefficient of determination?

A) -1 B) +1 C) 0 D) undefined

Assume that Stanton's Equipment, Land and Trademark on the date of acquisition form part of a single asset group. Assume also that these assets are expected to generate future cash flows of $40,000. Does this mean that Stanton will have to recognize an impairment loss? Explain.

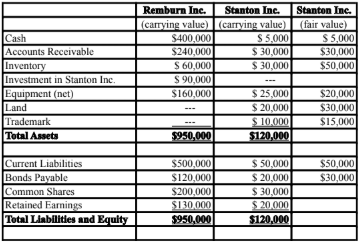

Remburn Inc. Inc. purchased 90% of the outstanding voting shares of Stanton Inc. for $90,000 on January 1, 2015. On that date, Stanton Inc. had common shares and retained earnings worth $30,000 and $20,000, respectively. The equipment had a remaining useful life of 10 years from the date of acquisition. Stanton's trademark is estimated to have a remaining life of 5 years from the date of acquisition. Stanton's bonds mature on January 1, 2035. The inventory was sold in the year following the acquisition. Both companies use straight line amortization, and no salvage value is assumed for assets. Remburn Inc. and Stanton Inc. declared and paid $12,000 and $4,000 in dividends, respectively during the year.

The balance sheets of both companies, as well as Stanton's fair values on the date of acquisition are shown below:

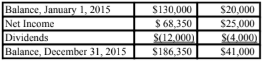

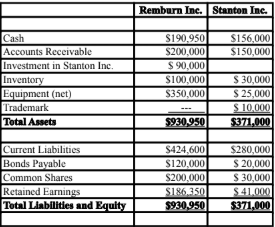

The following are the financial statements for both companies for the fiscal year ended December 31, 2015:

Income Statements

Retained Earnings Statements

Balance Sheets

Both companies use a FIFO system, and Stanton's entire inventory on the date of acquisition was sold during the following year. During 2015, Stanton Inc. borrowed $20,000 in cash from Remburn Inc. interest free to finance its operations. Remburn uses the Cost Method to account for its investment in Stanton Inc. Moreover,

Stanton sold all of its land during the year for $18,000. Goodwill impairment for 2015 was determined to be $7,000. Remburn has chosen to value the non-controlling interest in Stanton on the acquisition date at the fair value of the subsidiary's identifiable net assets (parent company extension method).

The markdown percent is the amount of markdown divided by the new sale price.

Answer the following statement true (T) or false (F)