The amount of non-controlling interest in Jay's 2019 Consolidated Net Income would be:

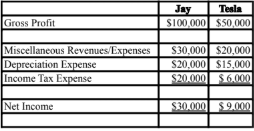

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2019 income statements of both companies are shown below.

On January 1, 2019, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%.

A) Nil. B) $1,458. C) $1,818. D) $1,800.

B) $1,458.

You might also like to view...

What do some executives fail to understand in dealing with the media?

A) that the public wants to be entertained B) that the reporter wants the story, whether good or bad C) that the media wants to be a friendly adversary D) that visual elements drive every news story

Jane and Joan decide to open a plumbing business. Both contribute money to the business, but

because Jane has expertise in plumbing, she makes all the management decisions. Joan will not participate in any of the day-to-day operations. Jane and Joan will split net income equally. This enterprise is: A) A partnership. B) Not a partnership because they do not share management responsibilities. C) Not a partnership because they do not co-own the business. D) Not a partnership because they are not carrying on a trade or business. E) Not a partnership because there is no association of two or more people.

The market potential in a given metropolitan area relative to the United States as a whole can be determined by using the

A. survey of buying power index. B. category development index (CDI). C. BAR/LNA. D. Nielsen rating index. E. brand development index (BDI).

Imagine you have been hired to work an internship in a resort hotel in Hilton Head, South Carolina, for the summer. The manager learns you have had this service marketing class. In talking with you, she states that she feels the hotel is not always providing satisfactory service and may be performing in some areas below customer expectations. She stops talking and looks at you. Remember your future career may be riding on your answer. What do you tell her?

What will be an ideal response?