Company Z has 8 million shares of common stock authorized with a par value of $1 and a market price of $72. There are 4 million outstanding shares and 1 million shares held in treasury stock.Required:Part a. Prepare the journal entry if the company declares and distributes a 10% stock dividend.Part b. Show the effect of the 10% stock dividend on assets, liabilities, and stockholders' equity.Part c. Prepare the journal entry if the company declares and distributes a 100% stock dividend.Part d. Show the effect of the 100% stock dividend on assets, liabilities, and stockholders' equity.

What will be an ideal response?

Part a

Declaration and distribution of a 10% stock dividend

| Retained Earnings ($72 Market value per share × | 28,800,000 |

| Common Stock ($1 × 4,000,000 Outstanding shares | 400,000 |

| Additional Paid-in Capital | 28,400,000 |

Part b

| Assets = Liabilities + | Stockholders' Equity |

| Retained Earnings | -28,800,000 |

| Additional Paid-in Capital | +28,400,000 |

| Common Stock | +400,000 |

Part c

Declaration and distribution of a 100% stock dividend

| Retained Earnings ($1 Par value per share × 4,000,000 | 4,000,000 |

| Common Stock | 4,000,000 |

Part b

| Assets = Liabilities + | Stockholders' Equity |

| Retained Earnings | -4,000,000 |

| Common Stock | +4,000,000 |

You might also like to view...

Large blocks of texts will help draw attention to your qualifications on the résumé

Indicate whether the statement is true or false.

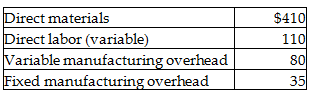

A supplier has offered to sell the component to Carver for $640 per unit. If Carver buys the component from the supplier, the released facilities can be used to manufacture a product that would generate a contribution margin of $20,000 annually. Assuming that Carver needs 3000 components annually and that the fixed manufacturing overhead is unavoidable, what would be the impact on operating income if Carver outsources?

Carver Company manufactures a component used in the production of one of its main products. The following cost information is available:

A) Operating income would decrease by $100,000.

B) Operating income would increase by $20,000.

C) Operating income would decrease by $20,000.

D) Operating income would increase by $120,000.

When releasing Mango Madness, Snapple asked retailers to put the new drink right next to mangos in the fruit aisle. The incentive for supermarkets was free mangos for participating. This ________ resulted in Snapple selling a lot more Mango Madness a lot faster and for a lot less money than if the company had just placed ads in consumer magazines and on TV.

A. viral marketing program B. sales promotion C. direct marketing activity D. advertorial E. publicity

The sales manager of Sebastian Company failed to record a valid sale on account of merchandise that had been shipped to a customer prior to the end of the current year; however, the company uses a periodic method of accounting for inventory and the merchandise had been properly excluded from inventory at the end of the current year. As a result of this error, Sebastian Company's

a. total assets are overstated for the current year. b. total expenses are understated for the current year. c. net income is overstated for the current year. d. total assets are understated at the end of the current year. e. none of the above.