What does it mean for a country to experience a capital inflow? Is this associated with a surplus or a deficit on the country's capital account?

What will be an ideal response?

Answer: When a country experiences a capital inflow, foreign residents are investing in domestic assets and domestic residents are selling foreign assets. These transactions are credits on the balance of payments because the country is effectively exporting assets. If capital inflows exceed capital outflows, there is a surplus on the country's capital account. This surplus would be offsetting a combined deficit on the current account and the official settlements account.

You might also like to view...

[The following information applies to the questions displayed below.] Lexington Company engaged in the following transactions during Year 1, its first year in operation: (Assume all transactions are cash transactions.)1) Acquired $6,000 cash from issuing common stock. 2) Borrowed $4,400 from a bank. 3) Earned $6,200 of revenues. 4) Incurred $4,800 in expenses. 5) Paid dividends of $800. Lexington Company engaged in the following transactions during Year 2: (Assume all transactions are cash transactions.)1) Acquired an additional $1,000 cash from the issue of common stock. 2) Repaid $2,600 of its debt to the bank. 3) Earned revenues, $9,000. 4) Incurred expenses of $5,500. 5) Paid dividends of $1,280. What was the net cash flow from financing activities reported on Lexington's

statement of cash flows for Year 2? A. $1,000 outflow B. $2,880 outflow C. $2,880 inflow D. $1,000 inflow

Make-or-buy decisions may lead to

A) outsourcing B) joint products C) a more diversified sales mix D) none of these choices

For firms interested in building long-term customer relationships, having satisfied customers is enough to ensure the relationship is going to last.

Answer the following statement true (T) or false (F)

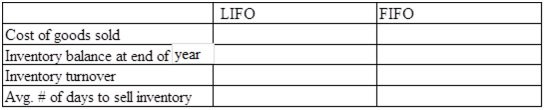

The following information relating to the current year was taken from the records of Poole Company: Beginning inventory200 units @ $110Purchase May 12100 units @ $120Purchase October 9150 units @ $125Sales360 units @ $180Required: a) Assuming that Poole uses the LIFO cost flow method, determine how much product cost would be allocated to cost of goods sold, and how much to inventory at the end of the year. b) Based on your results from part (a), calculate inventory turnover and average number of days to sell inventory. c) Assuming that Poole uses the FIFO cost flow method, determine how much product cost would be allocated to Cost of Goods sold, and how much to inventory at the end of the year. d) Based on your results from part (c), calculate inventory turnover and average number of

days to sell inventory. e) Compare your results from parts (b) and (d). Do LIFO and FIFO give the same results for inventory turnover? Which is higher, and why?

What will be an ideal response?