How does investment as a share of GDP in countries with more economic freedom compare with economies that are less free? How does the productivity of investment in the freer economies compare with its productivity in the less free economies? How will this influence differences in growth rates and income levels? Explain

Both investment as a share of GDP and the productivity of that investment are higher in countries with more economic freedom. This is highly important because investment and its productivity drive economic growth. Discovery of new improved products and production methods are also a driving force for economic growth. These discoveries generally lead to additional investment and improve productivity. Thus, improvements in technology and discovery of better ways of doing things are contributing factors to both the higher investment rates and greater investment productivity of the countries with more economic freedom.

You might also like to view...

According to Chamberlin, the fact that in the long run average total cost exceeds its minimum value under monopolistic competition is

A) the social cost of monopolistic competition. B) the most important reason for why monopolistic competition is not efficient. C) part of the cost of producing different products for consumers. D) actually beneficial because it makes adjustments easier when demand increases.

You are shopping at the local mall with an $80 gift certificate. Only three items catch your attention. The items include a Justin Bieber sheet set, a remote control helicopter, and an "Amazing Ab Belt." You would be willing to give up $60 for the sheets, $70 for the belt, and $80 for the helicopter. Knowing this, you decide to purchase the helicopter. The opportunity cost of the helicopter was:

A. $130, the combined value of the alternatives forgone. B. $80, the amount of the gift certificate spent. C. $70, the value of the ab belt. D. $60, the value of the sheets.

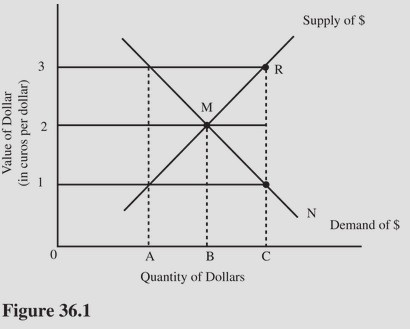

Ceteris paribus, an increase in the U.S. demand for Greek goods in Figure 36.1 will

Ceteris paribus, an increase in the U.S. demand for Greek goods in Figure 36.1 will

A. Result in a movement from M to R on the supply curve for dollars. B. Increase the dollar price of euros above $2 = 1 euro. C. Make U.S. goods more expensive to Greek residents. D. Result in a movement from M to N on the demand curve for dollars.

Describe the characteristics of private capital flows to DVC.

What will be an ideal response?