The difference in income between absorption and variable costing can be explained by the change in finished-goods inventory (in units) multiplied by the standard fixed manufacturing overhead rate.Required: Explain why this calculation accounts for the difference noted.

What will be an ideal response?

The only difference between the two methods is the treatment of fixed manufacturing overhead. Such amounts are expensed under variable costing whereas with absorption costing, a predetermined amount is attached to each unit manufactured. This applied overhead moves back and forth between the balance sheet and the income statement depending on what happens to inventory during the period (i.e., increase or decrease). Because of this situation, the change in inventory multiplied by the fixed manufacturing overhead per unit corresponds with the difference in reported income between absorption costing and variable costing.

You might also like to view...

The ________ style of advertising shows ordinary people clearly using a product in a normal setting

A) personality symbol B) slice of life C) mood or image D) testimonial evidence E) technical expertise

Metallic Engineering, Inc., a manufacturer of fabricated aluminum products for aerospace, engineering, automotive, and custom industrial applications, is calculating its WACC. The firm’s common stock just paid a dividend of $1.5 per share and now is selling for $30. The firm’s financial staff estimates the company’s new product will generate an unusual high dividend growth rate of 17% for four years. After this period of time, the dividend growth rate will decline to 3% during a transition period of 3 years, rather than instantaneously. The firm’s debt-to-equity ratio is 3/4 and the flotation costs for new equity will be 7%. Also, the firm has a payout ratio of 60% and 20M of common shares of stock outstanding.

a) Based on the information above, determine the firm’s estimated retained earnings and the associated break-point.

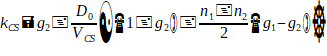

b) Calculate the firm’s cost of retained earnings and the cost of new common equity. Hint: use the required rate of return kCS derived from the H-Model formula in Chapter 9 as follows:

c) If Metallic Engineering’s after-tax cost of debt is 5%, determine the WACC with retained earnings and new common equity.

Which of the following marketing management orientations focuses primarily on improving efficiencies along the supply chain?

A) production concept B) product concept C) selling concept D) marketing concept E) societal marketing concept

Insurance companies are exempt from antitrust laws whenever state regulation exists

Indicate whether the statement is true or false