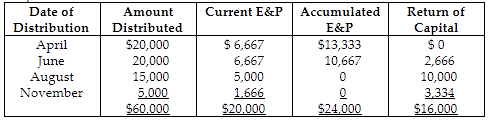

The treatment of the $15,000 August 1 distribution would be

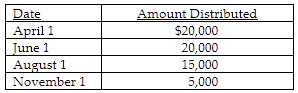

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year. Current E&P is $20,000. During the year, the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.

A) $15,000 is taxable as a dividend; $5,000 from current E&P and the balance from accumulated E&P.

B) $15,000 is taxable as a dividend from accumulated E&P.

C) $4,000 is taxable as a dividend from accumulated E&P, and $11,000 is tax-free as a return of capital.

D) $5,000 is taxable as a dividend from current E&P, and $10,000 is tax-free as a return of capital.

D) $5,000 is taxable as a dividend from current E&P, and $10,000 is tax-free as a return of capital.

You might also like to view...

Companies sometimes make a strategic decision not to patent a particular invention or process. Why might a company sometimes choose not to seek a patent?

What will be an ideal response?

______ occurs when some members of a team work less diligently or pursue team goals with less effort because they realize that there are others on the team who will pick up the slack.

a. Groupthink b. Social loafing c. Nonconformity d. Virtual miscommunication

The Overhead account is used to accumulate actual overhead costs

Indicate whether the statement is true or false

The quick ratio and the debt to equity ratio are measures of short-term debt-paying ability

Indicate whether the statement is true or false