Enterprise applications introduce switching costs

Indicate whether the statement is true or false

TRUE

You might also like to view...

“Come to my office to discuss the future” is an example of

a. general language. b. specific language. c. authoritarian language. d. democratic language.

What are the positive and negative outcomes of office gossip?

What will be an ideal response?

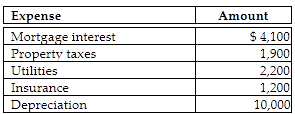

Using the IRS method of allocating expenses, the amount of depreciation that Abby may take with respect to the rental property will be

Abby owns a condominium in the Great Smokey Mountains. During the year, Abby uses the condo a total of 21 days. The condo is also rented to tourists for a total of 79 days and generates rental income of $12,500. Abby incurs the following expenses:

A) $5,074.

B) $8,515.

C) $7,900.

D) $10,000.

Marks Consulting purchased equipment costing $45,000 on January 1, Year 1. The equipment is estimated to have a salvage value of $5,000 and an estimated useful life of 8 years. Straight-line depreciation is used. If the equipment is sold on July 1, Year 5 for $20,000, the journal entry to record the sale will include a:

A) Credit to cash for $20,000. B) Debit to accumulated depreciation for $22,500. C) Debit to loss on sale for $10,000. D) Credit to loss on sale for $10,000. E) Debit to gain on sale for $2,500.