Over the long run, a government's fundamental source of revenues is

A) printing money.

B) user fees and taxes.

C) exports.

D) gold sales.

B

You might also like to view...

How does a change in taxes primarily affect aggregate demand? a. A tax change alters exports and net exports

b. A tax change alters investment by an equal and opposite amount. c. A tax change alters disposable income and consumption spending. d. A tax change alters government purchases by an equal amount.

If the nominal GDP were to increase, but the real GDP were to increase by less from one year to the next, we could conclude:

A. both prices and output went up. B. both prices and output stayed the same. C. prices stayed the same, but output went up. D. prices went up, but output stayed the same.

Based on the figure below. Starting from long-run equilibrium at point C, a decrease in government spending that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at__ creating _____gap.

A. B; no output B. D; an expansionary C. B; recessionary D. D; a recessionary

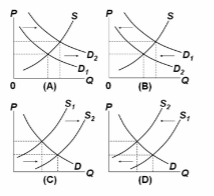

Which of the diagrams illustrate(s) the effect of a decrease in incomes on the market for secondhand clothing?

A. A and C.

B. A only.

C. B only.

D. C only.