Income statement and balance sheet data for The Sports Shack are provided below. The Sports ShackIncome StatementsFor the years ended December 31?20222021Sales revenue$8,200,000$6,600,000Cost of goods sold6,100,0004,700,000Gross profit2,100,0001,900,000 Expenses:?? Operating expenses1,450,0001,400,000 Depreciation expense90,000100,000 Interest expense25,00050,000 Income tax expense95,00080,000 Total expenses1,660,0001,630,000Net income$440,000$270,000The Sports ShackBalance SheetsDecember 31Assets202220212020Current assets:??? Cash$290,000$218,000$196,000 Accounts receivable1,050,000680,000880,000 Inventory919,0001,250,0001,100,000 Supplies80,00090,00065,000Long-term assets:???

Equipment1,100,0001,200,000(250,000) Less: Accumulated depreciation(440,000)(350,000)(250,000)Total assets$2,999,000$3,088,000$2,891,000Liabilities and Stockholders' EquityCurrent liabilities:??? Accounts payable$50,000$65,000$55,000 Interest payable2,0004,0006,000 Income tax payable38,00040,00030,000Long-term liabilities:??? Notes payable200,000400,000300,000Stockholders' equity:??? Common stock900,000900,000900,000 Retained earnings1,809,0001,679,0001,600,000Total liabilities and equity$2,999,000$3,088,000$2,891,000Required: 1. Calculate the following risk ratios for 2021 and 2022 (round to one decimal place). Receivables turnover ratioInventory turnover ratioCurrent ratioDebt to equity ratio2. Calculate the following profitability ratios for 2021 and 2022 (round to one decimal place). Gross profit ratioReturn on assetsProfit marginAsset turnover3. Based on the ratios calculated, determine whether overall risk and profitability improved from 2021 to 2022.

What will be an ideal response?

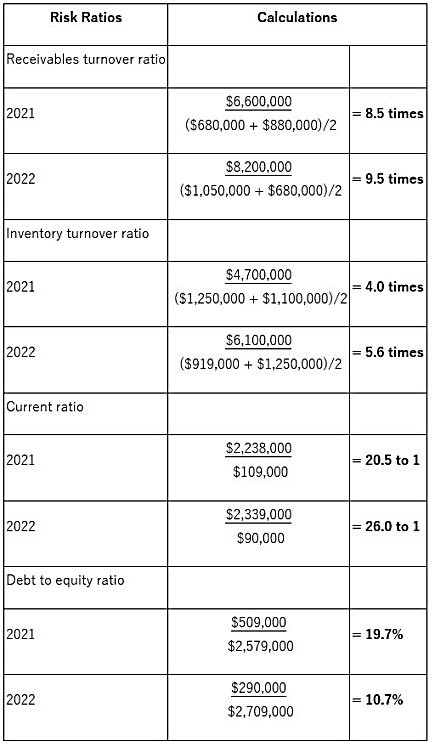

Requirement 1

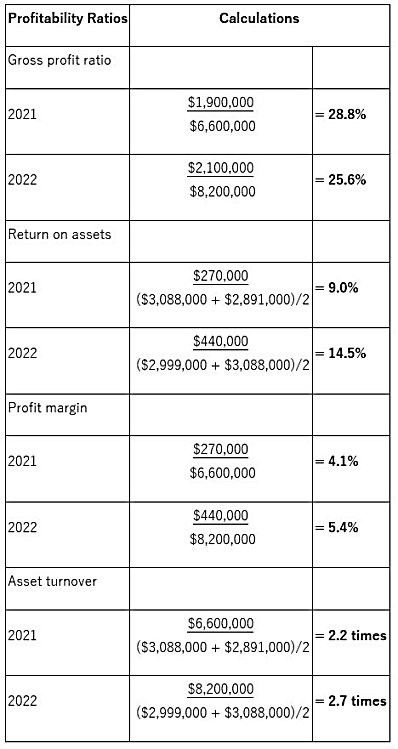

Requirement 2

Requirement 3

Based on the ratios calculated, the company's overall risk improved in 2022. The receivables turnover ratio, the inventory turnover ratio, and the current ratio all increased, while the debt to equity ratio decreased from 2021 to 2022. These are all positive signs of less risk for the company.

Based on the ratios calculated, the company's overall profitability improved in 2022. The return on assets, profit margin, and asset turnover ratios all increased, while the gross profit ratio decreased from 28.8% to 25.6%. Gross profit measures the amount by which the sales price of inventory exceeds its cost per dollar of sales. One factor that may cause a decrease in gross profit is increased competition in the industry resulting in a lower markup.

You might also like to view...

Which one of the following statements is true if a company's collection period for accounts receivable is unacceptably long?

a. The company may need to borrow to acquire operating cash. b. The company may offer trade discounts to lengthen the collection period. c. Cash flows from operations may be higher than expected for the company's sales. d. The company should expand operations with its excess cash.

In the UK, attaching a requirement or condition to organisational decision-making (for example, in recruitment) which, whilst applying to all individuals, disadvantages certain groups, is referred to as which of the following:

a. direct discrimination b. indirect discrimination c. victimisation d. structural discrimination

________ charts show the chain of command, from the boss down to the line managers and employees

Fill in the blank(s) with correct word

Project risks outside of company control such as economic conditions are referred to as?

a. Cost risks b. Technology risks c. Operational risks d. External risks