Which of the following represents the cost-plus pricing formula?

A. Price = cost + markup percentage.

B. Price = cost ÷ markup percentage.

C. Price = cost + (markup percentage + cost).

D. Price = cost + (markup percentage × cost).

E. Price = markup percentage × cost.

Answer: D

You might also like to view...

Why is it problematic for retailers to spend about the same on communication programs for each geographic region?

What will be an ideal response?

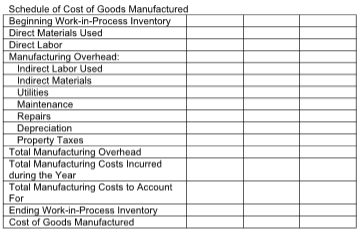

Required: Prepare a schedule of cost of goods manufactured for Varda, Inc. using the format below.

Varda, Inc. used $213,000 of direct materials and incurred $111,000 of direct labor costs during the

year. Indirect labor amounted to $8,100, while indirect materials used totaled $4,800. Other operating

costs pertaining to the factory included utilities of $9,300; maintenance of $13,500; repairs of $5,400;

depreciation of $23,700; and property taxes of $7,800. There was no beginning or ending finished goods

inventory. The Work-in-Process Inventory account reflected a balance of $16,500 at the beginning of the

period and $22,500 at the end of the period.

On June 3, Lakeland Company sold merchandise worth $1,600 on credit, terms 2/10, n/30. The merchandise sold had cost $1,100. The customer paid the amount on June 10. What is the required journal entry to record the payment received under the periodic inventory system?

A) Accounts Receivable 1,568 Sales Discounts 32Cash 1,600 B) Accounts Receivable 1,600 Sales Discounts 32Cash 1,568 C) Cash 1,568 Sales Discounts 32Accounts Receivable 1,600 D) Cash 1,600 Sales Discounts 32Accounts Receivable 1,632

Presented below are the financial balances for the Boxwood Company and the Tranz Company as of December 31, 2017, immediately before Boxwood acquired Tranz. Also included are the fair values for Tranz Company's net assets at that date. Boxwood Tranz Co. Tranz Co.?(all amounts in thousands) Book value Book value Fair value 12/31/2017 12/31/2017 12/31/2017Cash$870 $240 $240 Receivables 660 600 600 Inventory 1,230 420 580 Land 1,800 260 250 Buildings (net) 1,800 540 650 Equipment (net) 660 380 400 Accounts payable (570) (240) (240)Accrued expenses (270) (60) (60)Long-term liabilities (2,700) (1,020) (1,120)Common stock ($20 par) (1,980) Common stock ($5

par) (420) Additional paid-in capital (210) (180) Retained earnings (1,170) (480) Revenues (2,880) (660) Expenses 2,760 620 ??Note: Parenthesis indicate a credit balance??Assume a business combination took place at December 31, 2017. Boxwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Tranz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Tranz's fair value, Boxwood promises to pay an additional $5.2 (in thousands) to the former owners if Tranz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands).?Compute consolidated revenues immediately following the acquisition. A. $1,170. B. $3,540. C. $4,050. D. $2,880. E. $1,650.