A company's general ledger shows a cash balance of $2,380. Comparing the company's cash records with the monthly bank statement reveals several additional cash transactions such as deposits outstanding of $1,760, note collected by the bank on the company's behalf of $1,000, and interest earned of $20. The company also finds an error by the bank of an additional deposit of $100. Calculate the correct balance of cash.

What will be an ideal response?

$3,400

$2,380 + $1,000 + $20 = $3,400.

You might also like to view...

Several members of Hiroko's team feel frustrated. They had forwarded many viable concepts to management for work process improvements. A few of the concepts were implemented, but most were not, and the team was not told why. Most members have quit trying to come up with innovative ideas. The team seems to have failed due to

A) lack of interpersonal skills training. B) too much responsibility. C) lack of empowerment. D) employee discrimination. E) lack of procedural justice.

The Equal Pay Act requires that women who do the same job as men receive the same pay. What are the exceptions allowed in this act?

What will be an ideal response?

The available capacity will be influenced by:

I. product specification. II. product mix. III. work effort. IV. units of measurement A) II, III and IV only B) III only C) IV only D) I, II and III only E) I, II and IV only

In 2019, Gregory receives a reimbursement for last year's medical expenses of $1,200. As a result, Gregory must

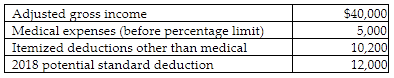

A review of the 2018 tax file of Gregory, a single taxpayer who is age 40, provides the following information regarding Gregory's 2018 tax status:

A) include $200 in gross income for 2019.

B) include $1,200 in gross income for 2018.

C) reduce 2018's medical expenses by $1,200.

D) amend the 2018 return.