A negative correlation always exists between sustainability and competitiveness

Indicate whether the statement is true or false

FALSE

You might also like to view...

What should the salesperson do if the prospect angrily challenges the veracity of the claims made about the product?

A. Act diplomatically. B. Take control of the presentation. C. Use the Paul Harvey dialogue. D. Give green signals. E. Politely correct the prospect.

In the 21st century, the power of public relations is no longer as great as it used to be

Indicate whether the statement is true or false

On January 1, 2018, A. Hamilton, Inc. ("AHI") provides a loan for $3,000,000 to Reynolds Manufacturing Corp. ("RMC"). The terms of the loan require payment of the loan no later than January 1, 2023. RMC was in terrible financial condition and would cease operations absent securing a loan. Prior to requesting a loan from AHI, RMC exhausted all other possible avenues for funding. The terms of the loan agreement include provisions that require RMC to provide AHI with the following from January 1, 2018 through January 1, 2023: (i) 6 percent annual interest on the principal amount of the loan, which reflects a market rate of interest; (ii) 100 percent participation rights to RMC's profits less $17,000 in a guaranteed annual dividend to RMC's common shareholders; and (iii) complete

decision-making authority over RMC's operations and financing decisions.At the end of the term of the loan, AHI is given the right to acquire RMC or, in its discretion, extend the term of the original loan an additional 5 years. At the date the loan was extended to RMC, RMC's common stock had an estimated fair value of $136,000 and a book value of $40,000. The $96,000 difference was attributed to an asset with a 3-year useful life remaining ("Asset"). At January 1, 2018, the balance sheets for AHI and RMC are as follows:January 1, 2018Balance SheetsAssetsAHIRMCCash 97,000 78,000 Accounts receivable 137,000 265,000 Loan receivable from AHI 3,000,000 - Asset with 3-year useful life remaining - 96,000 Equipment (net) 3,287,000 2,834,000 Total assets 6,521,000 3,273,000 ?Liabilities and owner's equityAHIRMCAccounts payable (219,000) (233,000)Long-term debts (688,000) (3,000,000)Common stock (4,800,000) (34,000)Retained earnings, 1/1/18 (814,000) (6,000)Total liabilities and equity (6,521,000) (3,273,000)?With respect to the acquisition-date consolidation worksheet, which of the following is accurate? A. The consolidated total long-term debt equals $3,688,000. B. The value of the noncontrolling interest is $40,000. C. The total liabilities and equity on a consolidated basis equals $5614,000. D. The total of all adjustments and eliminations equal $3,136,000. E. The total consolidated assets equal $9,794,000.

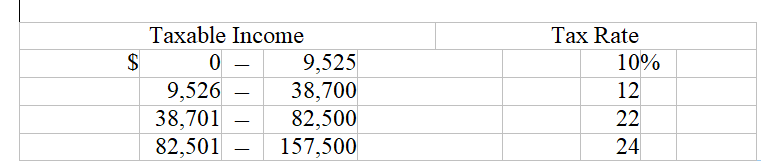

Given the personal income tax rates as shown, what is the average tax rate for an individual with taxable income of $118,700?

A) 24.00 percent

B) 22.36 percent

C) 19.00 percent

D) 21.94 percent

E) 21.00 percent