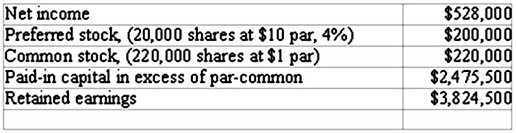

The following information was provided by Joseph Company as of December 31, Year 2: On the most recent trading date, Joseph's common shares sold at $36 and the preferred shares sold at $14.The following information on industry averages is provided:Earnings per share $2.06Price-earnings ratio 13.2:1Required:1) Calculate Joseph Company's (a) earnings per share and (b) price-earnings ratios. Round your answer to two decimal places.2) Discuss whether you would invest in this company.

On the most recent trading date, Joseph's common shares sold at $36 and the preferred shares sold at $14.The following information on industry averages is provided:Earnings per share $2.06Price-earnings ratio 13.2:1Required:1) Calculate Joseph Company's (a) earnings per share and (b) price-earnings ratios. Round your answer to two decimal places.2) Discuss whether you would invest in this company.

What will be an ideal response?

Answers will vary

1) (a) $2.36

1) (b) 15.25:1

2) It would be prudent to perform a much more thorough analysis of this company prior to making an investment decision. For example, the above ratios should be computed for more than one year to identify trends in the company's performance. Furthermore, additional ratios should be computed to assess the company's debt-paying ability and managerial effectiveness. Finally, non-quantitative factors would need to be considered (e.g., you may have heard that the company is about to be awarded a major contract.) However, based on this limited information, Joseph outperformed the industry: the earnings per share ratio and the price-earnings ratio for Joseph is above the average for the industry.

1) (a) Earnings per share = ($528,000 ? $8,000 preferred dividends) ÷ 220,000 common shares = $2.36

1) (b) Price-earnings ratio = $36 ÷ $2.36 = 15.25:1

You might also like to view...

The greatest disadvantage of tailored applications is their _____.

Fill in the blank(s) with the appropriate word(s).

When making financial decisions, managers should always look at marginal, or incremental cash

flows. Indicate whether the statement is true or false

The CEO of JLI Corp. decided to expand into a new market in 2010. At the end of 2010, JLI's stock

price had decreased 5% since the beginning of the year. Which of the following statements is MOST correct? A) The CEO made a poor decision to expand because the stock price decreased during the year. B) CEO decisions are irrelevant because the efficient market determines the value of a company's stock. C) The CEO's decision may have been optimal, keeping the stock price from falling more than 5% for the year. D) The CEO made a poor decision to expand because the company's profits for the year obviously decreased, causing the drop in stock price.

According to creativity consultant Roger von Oech, the ________ role in the creative process is to search for new information and pay attention to unusual patterns.

A. Judge B. Warrior C. Researcher D. Explorer E. Artist