A top-level manager at Jones & Ewing Financial, Sandra works with Bernice, a minority employee who has been identified as having high potential. As Bernice's mentor, one of Sandra's most important jobs is teaching Bernice about

A) Jones & Ewing's affirmative action policies.

B) the corporate culture and politics of Jones & Ewing Financial.

C) norms and values within the larger industry of which Jones & Ewing is a part.

D) how to address sexual harassment concerns at the company.

E) minorities at Jones & Ewing and their role in the company's history.

B) the corporate culture and politics of Jones & Ewing Financial.

Explanation: Mentors are higher-level managers who help ensure that high-potential personnel are introduced to top management and socialized into the norms and values of the organization.

You might also like to view...

Which of the following statements is true about the new concept of value creation?

A) It defines value based on stockholder welfares. B) It creates a profit-centric value. C) It defines value as only customer-perceived benefits. D) It creates real economic and social value.

A2Z Inc is a producer of a huge variety of consumer goods, from soaps to shower gels, and shampoos to detergents. It is a market leader in the United States and is planning to tap the immense potential in the emerging markets

Market research, however, indicates that the Brazilian culture and society are substantially different from their American counterparts. If the company wants to target the masses, which of the following options is most likely to succeed? A) A2Z can use a price skimming strategy to increase market share. B) The company's existing strategies in the United States will work just as well in Brazil. C) A2Z can introduce smaller "sachets" of shampoos and detergents that are priced lower. D) The company can introduce large family packs of shampoos and soaps even if they are priced higher than competitors. E) A2Z can use a predatory pricing strategy to capture the market.

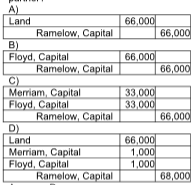

Floyd and Merriam share profits and losses equally. They agreed to dissolve the partnership and start a new one, admitting Ramelow for one-half share in the capital in exchange for land with a market value of $66,000. Which of the following is the correct journal entry to record the introduction of Ramelow as a partner?

Floyd and Merriam start a partnership business on June 12, 2019. Their capital account balances as of December 31, 2020 stood as follows:

![]()

The annual returns of three stocks for the past seven years are given in the following table:

a) Determine the average return and the standard deviation of returns for each stock. Which stock has the highest expected return and which one has the highest risk?

b) Determine the correlation coefficient and the covariance between each pair of stocks.

c) Determine the average return and the standard deviation of returns of equally weighted portfolios consisting of two stocks (XY, YZ, and XZ) and three (XYZ) stocks. How do the returns and standard deviations of the portfolios compare to those of the individual stocks?

d) Create a chart that shows how the standard deviation of the two-stock portfolios changes as the weight of one of the stocks changes.

e) Use the Solver to determine the minimum standard deviation that could be obtained by combining each pair of two stocks, and also all three stocks into a single portfolio.