Over the years, teachers' salaries in the U.S. have ________ with inflation and ________ relative to the salaries of equally credentialed occupations.

A. decreased; decreased

B. decreased; increased

C. increased; increased

D. increased; decreased

Answer: D

You might also like to view...

A tax that imposes a small excess burden relative to the tax revenue that it raises is

A) an efficient tax. B) a payroll tax. C) a sin tax. D) a FICA tax.

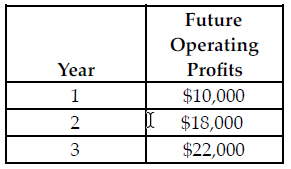

Refer to the table below. If the discount rate is 5 percent and the cost of the investment is $45,000, which of the following is true regarding a profit-maximizing manager?

The above table shows the future operating profits from an investment. The future operating profits are earned at the end of each of the respective years.

A) The manager should not make the investment because the net present value is positive.

B) The manager should not make the investment because the net present value is negative.

C) The manager should make the investment because the net present value is positive.

D) The manager should make the investment because the net present value is negative.

If the absolute value of the tax elasticity of supply is 0.5, a tax increase of 10 percent will

A. Decrease output by 5 percent and increase tax revenues. B. Increase output by 5 percent and decrease tax revenues. C. Increase output by 20 percent and decrease tax revenues. D. Decrease output by 5 percent and decrease tax revenues.

A bond offers a $50 coupon, has a face value of $1,000, and has 10 years to maturity. If the interest rate is 4.0% what is the value of this bond?

What will be an ideal response?