Bartech, Inc. is a firm operating in a competitive market. The manager of Bartech forecasts product price to be $28 in 2015. Bartech's average variable cost function is estimated to beAVC = 10 ? 0.003Q + 0.0000005Q2Bartech expects to face fixed costs of $12,000 in 2015. How much profit (loss) does Bartech, Inc. expect to earn?

A. -$2,500

B. $96,000

C. $156,000

D. $166,000

E. $127,000

Answer: B

You might also like to view...

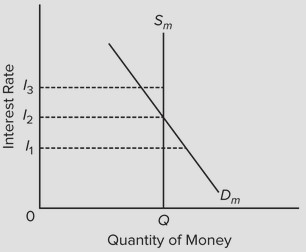

Use the following diagram for the market for money to answer the next question. The vertical money supply curve Sm reflects the fact that

The vertical money supply curve Sm reflects the fact that

A. bond prices and interest rates are inversely related. B. the rate at which money is spent is zero. C. the stock of money is determined by the Federal Reserve System and does not change when the interest rate changes. D. lower interest rates result in lower opportunity costs of supplying money.

Using a graph, show the effects of a negative externality. Where is the socially optimum point of output? How can it be achieved?

What will be an ideal response?

Suppose that the demand for medical services can be characterized by the equation P = 100 - Q. Suppose further that the supply of health services can be characterized by the equation P = Q + 50.

(a) What is the equilibrium quantity and price in the market for health services? (b) In an effort to make health services more affordable, the government restricts the price of health services to be no greater than $65. What will happen to the quantity of health services in the market?

The Fed would engage in ____ it wanted to address an inflationary gap

a. expansionary monetary policy b. contractionary monetary policy c. contractionary fiscal policy d. expansionary fiscal policy