On March 1, Cents, Inc. lent $1,000 to an employee at a rate of 6% for 3 months. The entry to record the loan of $1,000 to its employee includes a:

A. debit to Cash of $1,000.

B. credit to Cash of $1,000.

C. credit to Interest Revenue of $15.

D. credit to Notes Receivable of $1,000.

E. debit to Interest Revenue of $15.

Answer: B

You might also like to view...

What is the organization's responsibility in the goal-setting stage of the career management process?

A. to identify what skills can be developed realistically B. to communicate performance evaluation and opportunities available to an employee C. to identify goals and methods to determine goal progress D. to ensure that the goal is specific, challenging, and attainable E. to identify steps and a timetable to reach goals

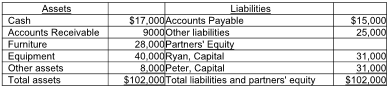

Ryan and Peter share profits in the ratio 3:2. They liquidate the partnership. The furniture and equipment sold at a loss of $50,000. The accounts receivable were collected in full and the other assets were written off as worthless. The cash balance remaining to pay the liabilities is ________.

The balance sheet of Ryan and Peter's partnership as of December 31, 2018, is given below.

A) $17,000

B) $94,000

C) $44,000

D) $40,000

For how long is the copyright protection provided to individuals under the Copyright Term Extension Act of 1998?

A) Individuals are granted 120 years copyright protection from the year of first publication of the work. B) Individuals are granted 95 years copyright protection from the year of creation of the work. C) Individuals are granted copyright protection for their lifetime plus 70 years. D) Individuals are granted 20 years of copyright protection, after which it has to be renewed for a fee.

Gift promises create legally enforceable contracts

Indicate whether the statement is true or false