the Federal Reserve System

What will be an ideal response?

adjusts the amount of currency in circulation

You might also like to view...

In a large open economy,

A) domestic lending and borrowing decisions have no impact on the world real interest rate. B) an increase in the domestic supply of loanable funds would lower the world real interest rate. C) the domestic equilibrium real interest rate is determined independently of foreign borrowing and lending. D) an increase in the domestic demand for loanable funds would lower the world real interest rate.

A bank's assets consist of $1,000,000 in total reserves, $2,100,000 in loans, and a building worth $1,200,000 . Its liabilities and capital consist of $3,000,000 in demand deposits and $1,300,000 in capital. If the required reserve ratio is 10 percent, what is the level of the bank's excess reserves? How much could it loan out as a result?

a. $700,000; $700,000 b. $700,000; $7,000,000 c. $300,000; $300,000 d. $300,000; $3,000,000

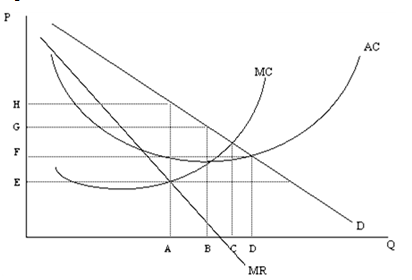

It's logical, it's a rule of thumb, it's an economic guideline: By producing at a quantity where MR = MC,

a. profit is guaranteed b. profit becomes zero c. the firm incurs a loss d. profit is maximized (or loss minimized) e. the firm should increase quantity

Figure 11-2

A. A B. B C. C D. D