During 2019, Barry (who is single and has no children) earned a salary of $13,100. He is age 30. His earned income credit for the year is:

A. $0.

B. $189.

C. $340.

D. $529.

Answer: B

You might also like to view...

The original creditors of both firms in a merger would benefit from the overall decrease in the probability of bankruptcy that attends the merger, which in turn results from the associated with creditors now having a claim against a larger

combined firm. a. tax reduction b. increased interest payments c. decreased principle d. co-insurance

During a period of recession the Federal Reserve 1. increases the target federal funds rate 2. buys government securities 3. sells government securities 4. lowers the target federal funds rate

A. 1 and 2 B. 1 and 3 C. 2 and 4 D. 3 and 4

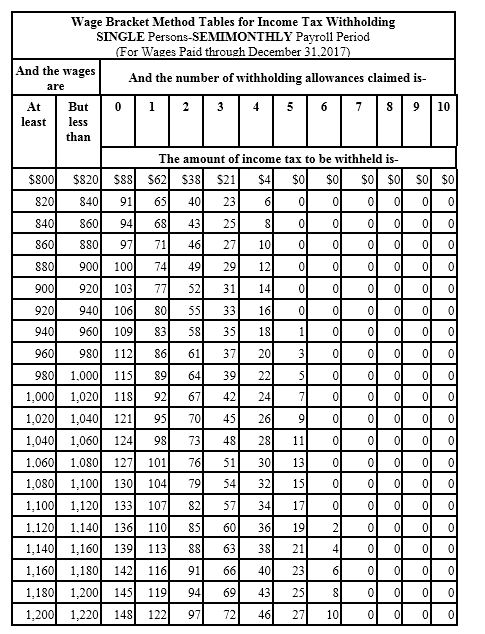

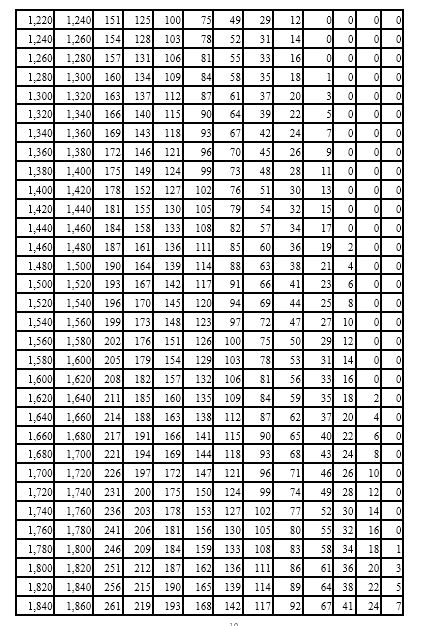

Julio is single with 1 withholding allowance. He earned $1,025.00 during the most recent semimonthly pay period. He needs to decide between contributing 3% and $30 to his 401(k) plan. If he chooses the method that results in the lowest taxable income, how much will be withheld for Federal income tax (based on the following table)?

A) $77.00

B) $86.00

C) $92.00

D) Both yield the same tax amount

Underpricing of an IPO would most likely be greatest in which of the following markets?

A) Australia B) China C) Japan D) United States