If a firm makes an economic profit, it is making at least a normal rate of return.

Answer the following statement true (T) or false (F)

True

You might also like to view...

How do payments on a fixed-payment loan differ from a coupon bond?

What will be an ideal response?

Which of the following is true about a Sweezy oligopoly?

A. The marginal revenue function has an upward "jump" or "discontinuity." B. The marginal cost function has an upward "jump" or "discontinuity." C. The marginal revenue function has a downward "jump" or "discontinuity." D. The marginal cost function has a downward "jump" or "discontinuity."

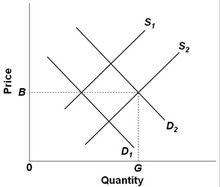

Use the following competitive market diagram for product Z to answer the question below. Assume that the current market demand and supply curves for Z are D1 and S1. If there are substantial external consumption benefits associated with the production of Z, then

Assume that the current market demand and supply curves for Z are D1 and S1. If there are substantial external consumption benefits associated with the production of Z, then

A. government can improve the allocation of resources by imposing a per-unit tax on Z. B. government can improve the allocation of resources by subsidizing consumers of Z. C. a government subsidy for producers of Z would ensure that consumers are paying directly for all benefits they receive from Z. D. consumers are paying too much for the good.

A distinguishing characteristic of public transfer payments is that:

A. there is a tax on the amount of the subsidy above a certain income level. B. the recipients make no contribution to current production in return for them. C. they are used to subsidize the major transportation carriers to reduce transportation costs. D. they are counted as part of government purchases in the calculation of the gross domestic product.