During the year just ended, the retailer James Corporation purchased $425,000 of inventory. The inventory balance at the beginning of the year was $175,000. If the cost of goods sold for the year was $450,000, then the inventory turnover for the year was:

A. 2.57

B. 2.62

C. 3.00

D. 2.77

Answer: D

You might also like to view...

Answer the following statements true (T) or false (F)

1.The imposition of government regulations (clean environment, workplace safety, product safety) on domestic steel companies tends to result in lower production costs and improved competitiveness. 2.The magnification effect suggests that the change in the price of a resource is smaller than the change in the price of the good that uses the resource relatively intensively. 3.According to the specific-factors theory, resources that are specific to import-competing industries tend to lose as a result of trade, while resources specific to export industries tend to gain as a result of trade. 4.Industrial policy includes using governmental subsidies as a tool to provide domestic firms an edge over foreign competitors in domestic and foreign markets. 5.The existence of transportation costs tends to result in increasing gains that a country receives from trade.

Peter is a sales engineer of Turner Associates, a machine tool manufacturer. During his routine visit to a customer's house, Peter finds out that the customer has a fresh requirement for two lathe machines. According to the text, Peter should move back to the ________ stage in relationship selling for the new machines.

A. preapproach B. presentation C. approach D. trial close E. close

In which of the following situations has conversion NOT occurred?

a. When an instrument is paid on a forged indorsement. b. When a drawee to whom a draft is delivered for acceptance properly returns it upon request. c. When any person to whom an instrument is delivered for payment refuses on demand to pay or to return it. d. When a bank pays an instrument containing only one of two required indorsements.

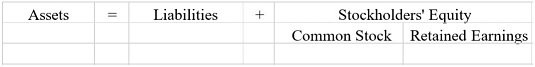

Show the effect of a stock dividend on the accounting equation (by using "+" or "-" in the elements affected).

What will be an ideal response?